Stop Paying Contractors to Fail

How outcome-based contracting can fix government's broken incentives

Daryl Wieland is Senior Director of Partnerships at Palantir and an Adjunct Professor of Finance at George Mason University.

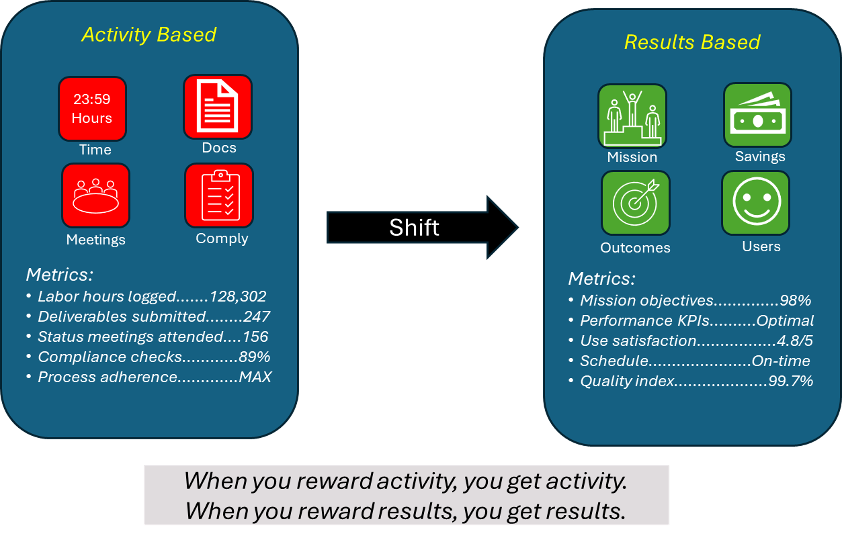

What is rewarded is repeated. For over a century, much of federal government contracting has rewarded the wrong behaviors and activities contrary to taxpayers’ wishes, resulting in wasted resources and missed schedules under activity-based contracts. Efficiency is punished, innovation discouraged, and effectiveness ignored.

Rather than a measurement or management problem, this is an incentive problem. When success means billing more hours instead of delivering results, failure becomes profitable. Contractors earn millions producing activity, not outcomes, while accountability drowns in timesheets and compliance theater.

The Dirty Little Secret

Many vendors are terrified of being paid for results. They’ve built business models on activity, not outcomes, preferring the certainty of activity-based billing to the accountability of performance-based pay.

The issue with activity-based contracting is summed up well by Upton Sinclair’s famous quote: “It is difficult to get a man to understand something when his salary depends upon his not understanding it.”

Outcome-based contracting highlights companies that create value. Instead of paying for hours, the government shares the value created with contractors who deliver it. This aligns contractor success with taxpayer benefit.

Still, success requires rigorous measurement of key metrics and contract structures that reward results.

It Can Be Done

A handful of examples, specifically in performance-based logistics (PBL) contracts, prove outcome-based contracting works.

For example, the C-17 Globemaster III represents one of the most celebrated PBL success stories in military aviation contracting. Beginning in 2002, the Air Force partnered with Boeing under the “Globemaster III Sustainment Partnership” (GSP), transitioning from traditional spare parts procurement to a comprehensive PBL arrangement. Under this contract, Boeing assumed responsibility for achieving specific aircraft availability rates rather than simply delivering parts and services.

The result was remarkable: mission-capable rates consistently exceeded 85%, often reaching above 90%, while significantly reducing the total cost of ownership. The C-17 PBL demonstrated how aligning contractor incentives with operational outcomes—paying for readiness rather than transactions—could transform sustainment performance. Boeing integrated supply chain management, depot maintenance, and engineering support into a seamless operation that adapted to the Air Force’s global mission demands, proving that industry could effectively manage complex weapon system sustainment when properly incentivized.

Similarly, The HH-60 Pave Hawk, the Air Force’s combat search and rescue helicopter, achieved PBL success through Sikorsky’s comprehensive sustainment contract beginning in the mid-2000s. This arrangement consolidated multiple legacy contracts into a single performance-based framework in which Sikorsky guaranteed aircraft availability rates while managing the entire supply chain and maintenance pipeline. The HH-60 PBL reduced supply response times dramatically, improved parts availability, and increased mission-capable rates while providing cost predictability for Air Force budget planners.

Both the C-17 and HH-60 programs demonstrated critical PBL success factors: clear performance metrics tied to warfighter needs, appropriate risk-sharing between government and contractor, access to technical data and reliable funding, and a cultural shift from adversarial oversight to collaborative partnership.

These programs became textbook examples taught at defense acquisition schools, proving that PBL could deliver superior readiness outcomes while controlling costs when implemented with well-structured contracts and committed partnerships.

Unfortunately, these examples are dated and few and far between.

How It Could Work

Outcome-based contracting needs rigorous measurement. Using decision analysis and quantitative methods, project value estimates can be made before completion and implemented in outcome-based payments. Here’s how:

1. Define the Real Decision

Instead of “Should we hire a firm to reduce improper payments?”, ask “How do we structure incentives to maximize improper payment reduction while minimizing false positives and administrative burden?”

Next, identify relevant factors such as baseline rates, current costs, industry benchmarks, vendor capabilities, and risk tolerance. Then define clear, measurable metrics that achieve your desired outcomes.

2. Quantify Uncertainty

Outcome-based contracts require accurate baselines. Use probability distributions, not point estimates. Account for real-world variability and correct for the all-too-common overconfidence of experts by having them attend calibration training. This simply means that when the expert says they are 90% confident about their estimate, the outcome is within their range nine out of ten times.

Early measurements update uncertainty about net benefits. These distributions have computable monetary value, the basis for outcome payments even when true results won’t be known for years.

3. Measure What Matters

Most programs measure the wrong things. The most uncertain variables get ignored while less meaningful metrics receive attention because they are easy to measure.

Calculate which metrics drive the value creation. Prioritize variables with highest impact on government outcomes. Often, overlooked variables are harder to measure but matter most.

4. Structure Risk-Informed Contracts

Model various outcome-based structures and compare expected results. Plan multiple scenarios, from modest success to breakthrough performance. Then ensure structures align with an agency’s risk appetite.

Illustrative Example: Improper Payments Prevention

Note: actual results may vary based on the variables for the specific use case.

Traditional activity-based approach: Pay $5 million annually for detection services and reports.

Outcome-based approach: Structure compensation to reward prevention and recovery while minimizing legitimate claim delays.

Define the real decision by focusing on improper payment prevention, not just detection. Start with the end in mind by determining the desired end goal or achievement. Keep focus on outcomes and avoid activity-based distractions.

Quantify uncertainty by using probability distributions to baseline the entire solution lifecycle. Point estimates are insufficient.

Measure what matters by finding the variables that impact the outcomes. Pressure test the assumptions that the models are based on. For instance, if “time to detection” is found to be four times as valuable as “total detection rate,” and “prevention accuracy” is eight times as valuable as “recovery rate,” then the contract incentives needed to focus on the time to detection and prevention accuracy variables.

Structure risk-informed contracts by modeling various scenarios where the range of outcomes inform leaders as to what they can expect given the current assumptions.

Projected Results (Illustrative):

Conservative: 25% reduction saves government $47M, contractor earns $4.2M

Expected: 45% reduction saves government $88M, contractor earns $7.8M

Breakthrough: 65% reduction saves government $129M, contractor earns $11.4M

Implementation Challenges

Outcome-based approaches require more upfront effort than activity-based approaches in order to structure them correctly and define the right metrics. Here are some of the more common additional challenges and how to address them:

Gaming the system: It is human nature to find the path of least resistance. To combat this, statistical process control, independent baseline verification, and automated anomaly detection can be implemented.

Attribution: As we all learned in Stats 101, correlation is not causation. Design measurement systems can be used to isolate the contractor contributions, as well as controlled testing with treatment and control groups.

Resistance: Bureaucratic culture also needs to be addressed, as anything new is usually met with a healthy level of skepticism. Demonstrate that well-designed outcome-based contracts are lower risk than activity-based arrangements, as the contractor only gets paid when the agency receives the desired outcomes.

The Path Forward

Immediate: Select high-impact pilots and calibrate your experts to include training the team in quantitative methods.

Medium-term: Develop contract templates to capture and improve on what has worked well and cultivate capable vendors that deliver.

Long-term: Shift from compliance-focused to outcome-focused culture and establish government-wide standards for outcome-based contracts.

Conclusion

Outcome-based contracting offers an escape from the dire incentives of activity-based contracting. However, it requires an upfront investment to identify desired outcomes and establish data-driven decision making.

By applying actuarial science and decision theory, agencies can implement outcome-based contracts with confidence, knowing metrics are statistically sound and structures align with their documented risk tolerance.

The result is a contracting approach that truly aligns contractor incentives with taxpayer interests, not through wishful thinking or regulatory mandates, but through the rigorous application of decision science and economic analysis. For agencies ready to move beyond paying for effort, compliance, or hours, this is the roadmap to driving outcomes.